Microsoft Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ||

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934 (Amendment No. __ )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| Preliminary Proxy Statement | ||

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

| Definitive Proxy Statement | ||

| Definitive Additional Materials | ||

| Soliciting Material Pursuant to §240.14a-12 | ||

Microsoft Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ||

| No fee required. | ||||

Fee computed on table below per Exchange Act Rules 14a-6(i) | ||||

| Title of each class of securities to which transaction applies: |

| (2) | ||||

| Aggregate number of securities to which transaction applies: |

| (3) | ||||

| Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | ||||

| Proposed maximum aggregate value of transaction: |

| (5) | ||||

| Total fee paid: |

Fee paid previously with preliminary materials. |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||||

| Amount Previously Paid: |

| Form, Schedule or Registration Statement No.: |

| Filing Party: |

| Date Filed: |

Persons who are to respond to the collection of information contained in this form are not

required to respond unless the form displays a currently valid OMB control number.

Notice of Annual Shareholders Meeting and

ProxyStatement

December 2, 2015 at 8:00 a.m. Pacific TimeMeydenbauer Center11100 NE 6th StreetBellevue, Washington 98004

Notice of Annual Shareholders Meeting and 2016 Proxy Statement | ||||

November 30, 2016 at 8:00 a.m. Pacific Time Meydenbauer Center 11100 NE 6th Street Bellevue, Washington 98004 | ||||

Proof of ownership required for admission See Part | ||||

October 18, 2016 | ||||||||

Letter from our Independent Chairman and our CEO | ||||||||

|

| Dear Shareholder, We invite you to attend the Annual Shareholders Meeting of Microsoft Corporation (“Annual Meeting”), which will be held at Meydenbauer Center, 11100 NE 6th Street, Bellevue, Washington 98004, on | ||||||

| ||||||||

The attached Notice of Annual Shareholders Meeting and Proxy Statement contain details of the business to be conducted at the Annual Meeting. Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted at the meeting. We urge you to promptly vote and submit your proxy via the Internet, by phone, or by signing, dating, and returning the enclosed proxy card in the enclosed envelope. If you attend the Annual Meeting, you can vote in person even if you previously submitted your proxy. This year’s shareholder question and answer session will include both live questions and questions submitted in advance. You may submit a question in advance through the Shareholder Forum available atwww.theinvestornetwork.com/forum/msft/default.aspx; we will respond to as many inquiries as time allows. We again are offering a virtual shareholder meeting through which you can view the meeting, submit questions, and vote online, at On behalf of the Board of Directors, thank you for your continued investment in Microsoft. We look forward to greeting as many of you as possible.

| ||||||||

| ||||||||

October 18, 2016 | ||||||

Letter

| ||||||

|

Dear Shareholder, As stewards of Microsoft, the Board of Directors greatly values its engagement with our shareholders. With this proxy filing, we would like to highlight Shareholder engagement It has long been a priority of our Board to maintain an active dialogue with our 3.5 million shareholders around the globe. In addition to direct communications with shareholders, we’re using a range of technologies to realize the value of one-to-many communication with our shareholders in our increasingly digital, dispersed world. • Interactive Proxy.An interactive version of our 2016 Proxy Statement makes it easy for you to efficiently access and consume the Proxy Statement content using an intuitive and easily navigable framework. This is important, because it puts our proxy directly in your hands, so you can immediately access the specific information you want, when, how, and where you want it. • Virtual Shareholders Meeting. For those who cannot attend our Annual Meeting in person, we provide a virtual shareholders meeting through which investors can view the meeting, submit questions, and vote online. A live webcast of the Annual Meeting, as well as a transcript and archived webcast after the meeting will be available on the Investor Relations website so the meeting is accessible to all our shareholders, no matter your location, availability, or format preference for accessing the meeting. • Director Video Series. We provide an opportunity for you to get to know our Board of Directors, and learn how we approach serving shareholders through ourdirector video series. We recently released two new installments featuring John Thompson and Padmasree Warrior. Additional information about our shareholder engagement efforts can be found in the “Corporate Governance at Microsoft” section of the proxy. | |||||

| ||||||

Governance enhancements We routinely evaluate Microsoft’s governance practices to maintain strong This action follows last year’sadoption of a “Proxy Access for Director Nominations” bylaw, which permits a shareholder or a group of up to 20 shareholders owning three percent or more of Microsoft’s outstanding shares continuously for at least three years, to have the ability to nominate two individuals or 20% of the Board’s seats (whichever is greater), provided the shareholders and nominees satisfy the requirements specified in the bylaws. We recently amended our

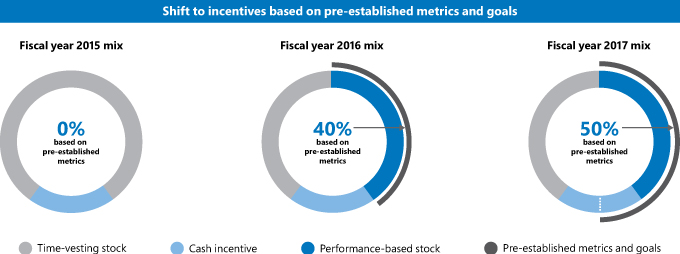

The continuing evolution of pay at Microsoft Our executive compensation | ||||||

| ii |  |

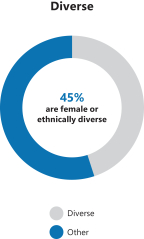

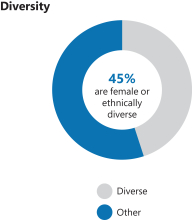

Through our ongoing shareholder engagement, we Additional details can be found under Proposal 2: Advisory vote on named executive officer compensation. Board composition and refreshment We are committed to having our Board include a diverse range of perspectives and experiences. This year, our Board is more diverse than ever, with women and ethnic minorities holding five of 11 Board positions. While there is still more work to be done, we are pleased that our efforts have created

Corporate social responsibility Microsoft’s corporate social responsibility commitments contribute long-term value to our business, Earlier this year we introduced Microsoft Philanthropies to One of our first initiatives is the donation of $1 billion in Microsoft cloud services to nonprofits and university researchers over the next three years. Our objective is to help recipients around the world obtain the access they need and deserve to pursue cutting-edge solutions to society’s most pressing problems. For more information about Microsoft Philanthropies, please visit:https://www.microsoft.com/about/philanthropies/. Communicating with the Board We deeply value the continued interest of and feedback from our shareholders, and are committed to maintaining our active dialogue with you to ensure a diversity of perspectives are thoughtfully considered. As we move closer to our Annual Meeting, we invite you to write us atAskBoard@microsoft.com about the Board of Directors or corporate governance at

|

We deeply value the continued interest of and feedback from our shareholders, and are committed to maintaining our active dialogue with shareholders to ensure a diversity of perspectives are thoughtfully considered. As we move closer to our Annual Meeting, we invite you to write us atAskBoard@microsoft.com about the Board of Directors or corporate governance at Microsoft.

Thank you for the trust you place in us. We appreciate the opportunity to serve Microsoft on your behalf.

Sincerely,

|  |  |

2016 PROXY STATEMENT iii

|  |  | ||||||

|

|

| ||||||

|  Thank you for the trust you place in us. We appreciate the opportunity to serve Microsoft on your behalf. Sincerely, |  | ||||||

Bill Gates |

Sandra E. Peterson |

| ||||||

|

Teri L. List-Stoll |

Charles W. Scharf | ||||||

G. Mason Morfit |

John W. Stanton | |||||||

Satya Nadella |

John W. Thompson | |||||||

Charles H. Noski |

Padmasree Warrior | |||||||

Helmut Panke | ||||||||

| iv |  |

Notice of 20152016 Annual Shareholders Meeting

|

| ||

Date | November 30, 2016 | ||

| Time | 8:00 a.m. Pacific Time | ||

| Place | Meydenbauer Center, | ||

| Record date |

| ||

| Proxy voting |

| ||

| Items of business | • To elect the 11 director nominees named in this Proxy Statement • To approve, on a non-binding advisory basis, the compensation paid to our Named Executive Officers • To ratify the selection of Deloitte & Touche LLP as our independent auditor for fiscal year • To approve an amendment to our Amended and Restated Articles of Incorporation • To approve a French Sub Plan under the 2001 Stock Plan • To consider and vote on two shareholder proposals described in the accompanying Proxy Statement, if properly presented at the Annual Meeting • To transact other business that may properly come before the Annual Meeting | ||

Virtual meeting | You also may vote at the | ||

Admission to | Proof of share ownership will be required to enter the Annual Meeting. See Part | ||

Important notice regarding the availability of proxy materials for the Annual Meeting to be held on |

By order of the Board of Directors

John A. Seethoff

Bradford L. Smith

Secretary

Redmond, Washington

October 19, 201518, 2016

The use of cameras at the Annual Meeting is prohibited and they will not be allowed into the meeting or any other adjacent areas, except by credentialed media. We realize that many mobile phones have built-in cameras; while these phones may be brought into the venue, the camera function may not be used at any time.

2015 Proxy Statement 2016 PROXY STATEMENTv

Proxy Statement table of contents

| 1 | ||||||||||||||

| 1 |

|

Corporate governance |

| 7 | ||||||||||

Our corporate governance cycle promotes effective shareholder engagement | 7 | |||||||||||||

| 8 | ||||||||||||||

| 8 | ||||||||||||||

| 9 | ||||||||||||||

We have independent Board committees with appropriate expertise | 9 | |||||||||||||

| 9 | ||||||||||||||

| 10 | ||||||||||||||

| 10 | ||||||||||||||

| 10 | ||||||||||||||

| 10 | ||||||||||||||

| 10 | ||||||||||||||

| 11 | ||||||||||||||

| 11 | ||||||||||||||

| 2 |

|

Board of Directors |

| 12 | ||||||||||

| 12 | ||||||||||||||

Shareholder recommendations and nominations of director candidates | 14 | |||||||||||||

| 15 | ||||||||||||||

| 20 | ||||||||||||||

| 21 | ||||||||||||||

| 21 | ||||||||||||||

| 21 | ||||||||||||||

| 22 | ||||||||||||||

| 23 | ||||||||||||||

| 23 | ||||||||||||||

| 24 | ||||||||||||||

| 25 | ||||||||||||||

Director stock ownership policy aligns interests with | 25 | |||||||||||||

| 26 | ||||||||||||||

| 3 |

|

Named executive |

| Proposal 2: Advisory vote on Named Executive Officer compensation | 27 | |||||||||

| 27 | ||||||||||||||

| 29 | ||||||||||||||

| 29 | ||||||||||||||

| 34 | ||||||||||||||

| 36 | ||||||||||||||

Section 4 – Compensation design process for fiscal year 2016 | 42 | |||||||||||||

| 44 | ||||||||||||||

| 47 | ||||||||||||||

| 47 | ||||||||||||||

| 47 | ||||||||||||||

| 48 | ||||||||||||||

| 49 | ||||||||||||||

| 50 | ||||||||||||||

| 50 | ||||||||||||||

| 51 | ||||||||||||||

| 51 | ||||||||||||||

| 52 | ||||||||||||||

| 53 | ||||||||||||||

| 53 | ||||||||||||||

2015 Proxy Statement vii

| vi |  |

| 4 |

|

Audit Committee |

| Proposal 3: Ratify Deloitte & Touche LLP as Independent Auditor for Fiscal Year 2017 | 54 | |||||||||

| 54 | ||||||||||||||

| 56 | ||||||||||||||

| 56 | ||||||||||||||

| 56 | ||||||||||||||

| 57 | ||||||||||||||

| 57 | ||||||||||||||

| 57 | ||||||||||||||

| 5 |

|

Other management |

| 58 | ||||||||||

| 58 | ||||||||||||||

Proposal 5: Approve French Sub Plan under the 2001 Stock Plan | 59 | |||||||||||||

| 59 | ||||||||||||||

| 60 | ||||||||||||||

Federal income tax consequences relating to the 2001 Stock Plan, as amended and restated | 62 | |||||||||||||

| 6 |

|

Shareholder |

| 65 | ||||||||||

| 68 | ||||||||||||||

| 7 |

|

Information about |

| 70 | ||||||||||

| 70 | ||||||||||||||

| 70 | ||||||||||||||

| 71 | ||||||||||||||

| 71 | ||||||||||||||

| 71 | ||||||||||||||

| 71 | ||||||||||||||

| 71 | ||||||||||||||

| 71 | ||||||||||||||

| 72 | ||||||||||||||

| 72 | ||||||||||||||

| 73 | ||||||||||||||

| 73 | ||||||||||||||

| 73 | ||||||||||||||

| 74 | ||||||||||||||

Annex A — reconciliation of non-GAAP and GAAP financial measures | 75 | |||||||||||||

| 76 | ||||||||||||||

| 79 | ||||||||||||||

2016 PROXY STATEMENT vii

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider. Please read the entire Proxy Statement carefully before voting.

|

|

|  | ||||

|

| ||||||

|

Meeting | ||||||

Record date |

| ||||||

September 30, 2016 Voting | Shareholders as of the record date are entitled to vote. Each share of common stock of Microsoft Corporation (the “Company”) is entitled to one vote for each director nominee and one vote for each of the proposals to be voted on. | Meeting agenda • Elect 11 directors • Advisory vote on executive compensation • Ratify Deloitte & Touche LLP as our independent auditor for fiscal year 2017 • Approve an amendment to our Amended and Restated Articles of Incorporation • Approve French Sub Plan under the 2001 Stock Plan • Consider and vote on two shareholder proposals described in the accompanying Proxy Statement, if properly presented at the Annual Meeting • Transact other business that may properly come before the meeting | |||||

| |||||||

| Date November 30, 2016 Time 8:00 a.m. Pacific Time Place Meydenbauer Center 11100NE 6th Street Bellevue,Washington 98004 | |||||||

Voting matters and vote recommendation

Item | Board | Reasons for recommendation | More infor- | |||||||||

| 1. | Election of 11 directors |

FOR | The Board and Governance and Nominating Committee | Page XX | ||||||||

| ||||||||||||

| 2. | Advisory vote on executive compensation |

FOR | Our executive compensation programs demonstrate the continuing evolution of our pay for performance philosophy, and reflect the input of shareholders from our extensive outreach efforts. | Page | ||||||||

| 3. | Ratification of the selection of Deloitte & Touche LLP as our independent auditor for fiscal year |

FOR |

| Based on the Audit Committee’s assessment of Deloitte & Touche’s qualifications and performance, it believes | Page XX | |||||||

| 4. | Amendment to our Amended and Restated Articles of Incorporation |

FOR |

| |||||||||

| Page XX | ||||||||||

| 5. | French Sub Plan under the 2001 Stock Plan |

FOR | Providing tax-advantaged equity compensation to our French employees is required to offer market-competitive compensation. | Page XX | ||||||

| 6. | Requesting certain proxy access bylaw amendments |

AGAINST | We have a robust and workable proxy access bylaw that reflects extensive feedback from our investors, and has terms that are widely embraced by companies adopting proxy access and widely accepted by institutional shareholders’ voting policies. | Page XX | ||||||

| 7. | Restricting actions that impair the effectiveness of shareholder votes |

AGAINST | We provide our shareholders many rights protecting their vote. The proposal is too vague and does not ask us to take any specific action. | Page XX | ||||||

2016 PROXY STATEMENT 1

Vote in advance of the meeting | ||||||||

|  |

Vote your shares atwww.proxyvote.com. Have your Notice of Internet Availability or proxy card in hand for the12-digit control number needed to vote. | ||||||

|

| Call toll-free number | ||||||

| Sign, date, and return the enclosed proxy card or voting instruction form. |  | ||||||

Vote in person at the meeting |

|

| ||||||

| ||||||||

2015 Proxy Statement 1Our director nominees

The following table provides summary information about each director nominee. Each director is elected annually by a majority of votes cast.

| Name Occupation | Director since | Other public boards | Committee memberships | |||||||||||||

| Age | Independent | AC | CC | GN | RPP | |||||||||||

| William H. Gates III | 59 | 1981 | No | 1 | ||||||||||||

| Co-Chair and Trustee, | ||||||||||||||||

| Bill & Melinda Gates Foundation | ||||||||||||||||

| Teri L. List-Stoll | 52 | 2014 | Yes | 1 |  |  | ||||||||||

| Executive Vice President and | ||||||||||||||||

| CFO, DICK’S Sporting Goods, Inc. | ||||||||||||||||

| G. Mason Morfit | 40 | 2014 | Yes | 0 |  |  | ||||||||||

| President, ValueAct Capital | ||||||||||||||||

| Satya Nadella | 48 | 2014 | No | 0 | ||||||||||||

| CEO, Microsoft | ||||||||||||||||

| Charles H. Noski | 63 | 2003 | Yes | 2 |  |  | ||||||||||

| Former Vice Chairman, |  | |||||||||||||||

| Bank of America Corporation | ||||||||||||||||

| Helmut Panke | 69 | 2003 | Yes | 2 |  |  |  | |||||||||

| Former Chairman of the Board of | ||||||||||||||||

| Management, BMW Bayerische | ||||||||||||||||

| Motoren Werke AG | ||||||||||||||||

| Sandra E. Peterson | 56 | N/A | Yes | 1 | ||||||||||||

| Group Worldwide Chairman, | ||||||||||||||||

| Johnson & Johnson | ||||||||||||||||

| Charles W. Scharf | 50 | 2014 | Yes | 1 |  | |||||||||||

| CEO, Visa, Inc. | ||||||||||||||||

| John W. Stanton | 60 | 2014 | Yes | 1 |  |  | ||||||||||

| Chairman, Trilogy International | ||||||||||||||||

| Partners, Inc. | ||||||||||||||||

| John W. Thompson | 66 | 2012 | Yes | 0 |  |  | ||||||||||

| Independent Chairman, Microsoft; | ||||||||||||||||

| CEO, Virtual Instruments, Inc. | ||||||||||||||||

| Padmasree Warrior | 55 | N/A | Yes | 2 | ||||||||||||

| Former Chief Strategy and Technology | ||||||||||||||||

| Officer, Cisco Systems, Inc. | ||||||||||||||||

Name Occupation | Director since | Other public boards | Committee memberships | |||||||||||||

| Age | Independent | AC | CC | GN | RPP | |||||||||||

William H. Gates III Co-Chair and Trustee, Bill & Melinda Gates Foundation | 60 | 1981 | No | 1 | ||||||||||||

Teri L. List-Stoll Former Executive Vice President and CFO, DICK’S Sporting Goods, Inc. | 53 | 2014 | Yes | 1 |

|

| ||||||||||

G. Mason Morfit President, ValueAct Capital | 41 | 2014 | Yes | 0 |

|

| ||||||||||

Satya Nadella CEO, Microsoft | 49 | 2014 | No | 0 | ||||||||||||

Charles H. Noski Former Vice Chairman, Bank of America Corporation | 64 | 2003 | Yes | 2 |

|

| ||||||||||

Helmut Panke Former Chairman of the Board of Management, BMW Bayerische Motoren Werke AG | 70 | 2003 | Yes | 1 |

|

| ||||||||||

Sandra E. Peterson Group Worldwide Chairman, Johnson & Johnson | 57 | 2015 | Yes | 0 |

| |||||||||||

Charles W. Scharf CEO, Visa, Inc. | 51 | 2014 | Yes | 1 |

|

| ||||||||||

John W. Stanton Chairman, Trilogy Partnerships | 61 | 2014 | Yes | 2 |

|

| ||||||||||

John W. Thompson Independent Chairman, Microsoft; Former CEO, Virtual Instruments, Inc. | 67 | 2012 | Yes | 0 |

|

| ||||||||||

Padmasree Warrior U.S. CEO and global Chief Development Officer, NextEV | 55 | 2015 | Yes | 0 |

| |||||||||||

| ||||||

| ||||||

| ||||||

AC: Audit Committee CC: Compensation Committee GN: Governance and Nominating Committee RPP: Regulatory and Public Policy Committee |

|

|

|

| 2 |  |

Corporate governance highlights

See Part 1 – “Corporate governance at Microsoft” for more information.

Our directors | ||||||

|  |  |

| ||||

|

| ||||

| ||||

•Independent Chairman of the • • All committee members are independent • Independent directors meet in executive session • Our Board and committees conductannual evaluations • We haverobust director orientation and continuing education programs for directors • We are committed to Board • All Audit Committee members are financially literate and 3 are • Our Compensation Committee uses anindependent compensation consultant | ||||

Progressive shareholder rights | ||||

| ||||

• Directors areelected by majority vote in uncontested elections • All directorselected annually • Our bylaws provide forproxy access by shareholders • We have a • If Proposal 4 is approved,15% of outstanding shares can call a special meeting | ||||

Vigorous shareholder engagement | ||||

|

| |||

| During fiscal year | ||||

2015 Proxy Statement 2016 PROXY STATEMENT3

Table of ContentsExecutive compensation matters

See Part 3 – “Named Executive Officerexecutive officer compensation” for more information.

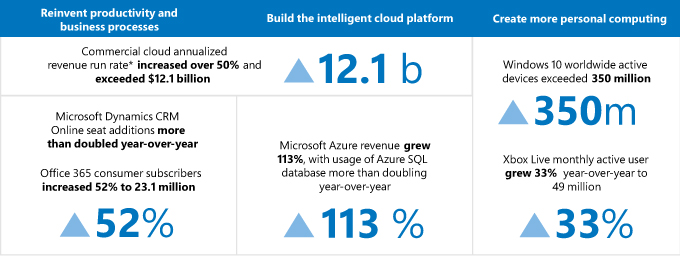

Our business performance |

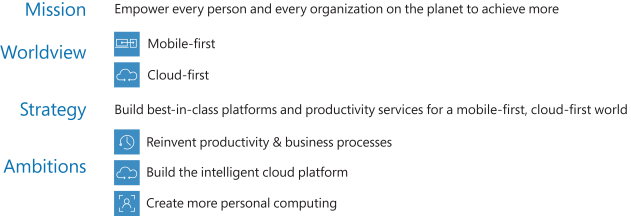

Executing on our three ambitions

We continued to advance our mission to empower every person and every organization on the planet to achieve more. We continued to cultivate a Microsoft culture in which people connect their individual energies and passions for technology to this mission. We achieved product development milestones, implemented organizational changes, and made strategic and tactical moves to support the three ambitions that support our strategy.

Our ambitions and achievements | ||||||

|

|

In June 2016, we agreed to acquire LinkedIn for $26.2 billion. Our goal for this transaction is to create new experiences and new value for our customers by connecting the world’s leading professional cloud and professional network.

Financial results

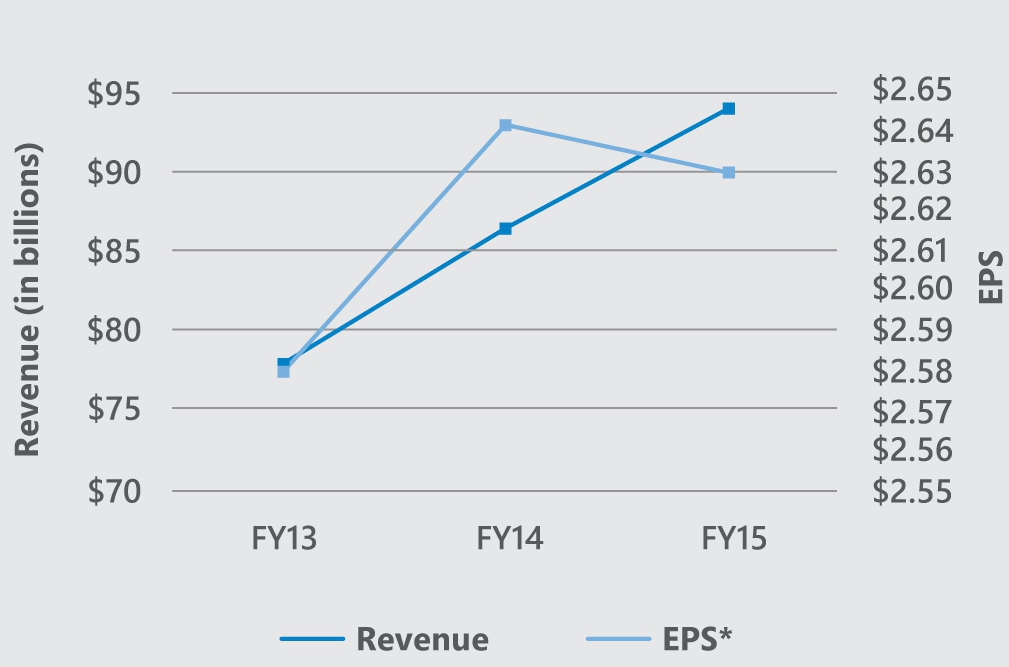

We balanced investments in growth opportunities and innovation with ongoing financial discipline, with the following financial results.

GAAP | non-GAAP* | |||

Revenue | $85.3 billion (down 9%) | $92.0 billion (down 2%) | ||

Operating income | $20.2 billion (up 11%) | $27.9 billion (down 1%) | ||

Net income | $16.8 billion (up 38%) | $22.3 billion (up 3%) | ||

Diluted earnings per share | $2.10 (up 42%) | $2.79 (up 6%) | ||

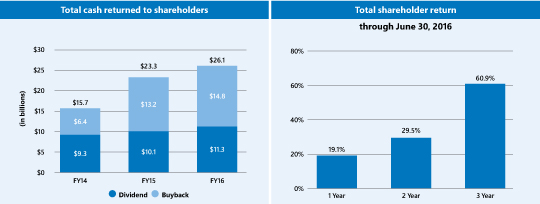

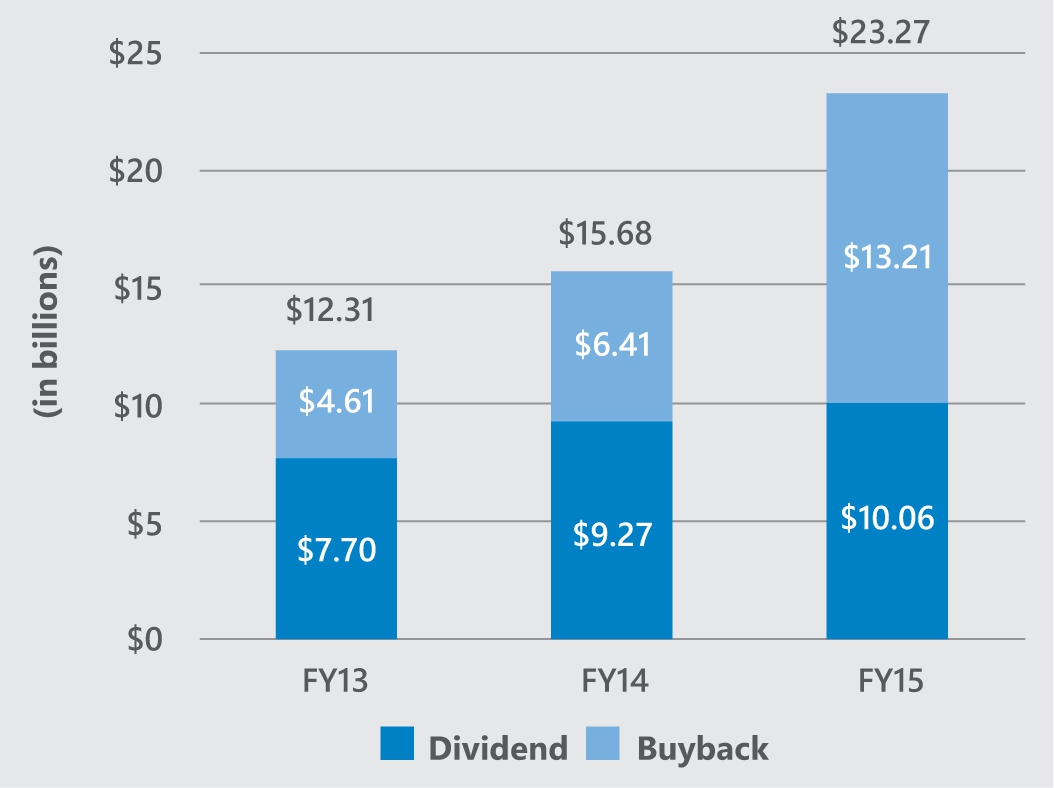

Total cash returned to | Increased 12% to $26.1 billion | |||

One-year total shareholder return

| 19.1% | |||

| * | See Annex A for a reconciliation of non-GAAP and GAAP |

Revenue decreased $8.3 billion primarily due to the impact of the $6.6 billion net revenue deferral from Windows 10 and an unfavorable foreign currency impact of approximately $3.8 billion. Operating income increased $2.0 billion, mainly due to a decrease in impairment, integration, and restructuring expenses related to our phone business and lower sales and marketing expenses, offset in part by lower gross margin.

| 4 |  |

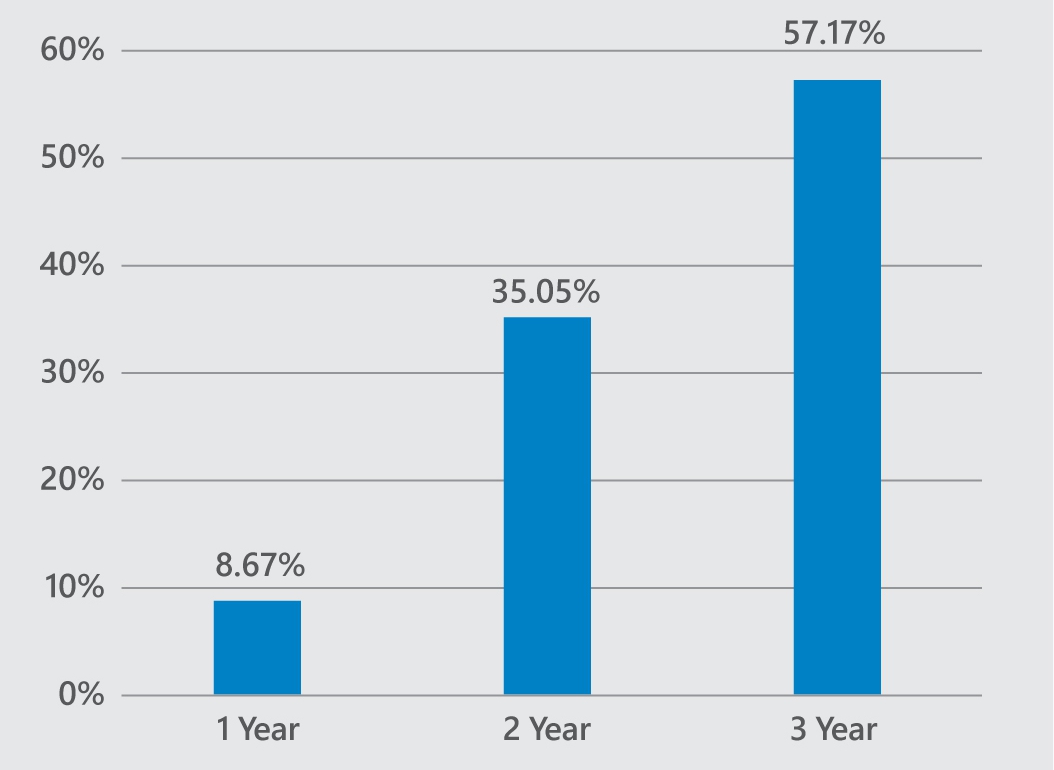

Strong long-term performance

Our total shareholder return (“TSR”), cash returned to shareholders, and annual revenue for the past three years have been strong, notwithstanding the impact of our business realignment on our fiscal year 2016 profitability.

Note about forward-looking statements | ||||

| ||||

| This Proxy Statement includes estimates, projections and statements relating to our business plans, objectives and expected operating results that are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements may appear throughout this report, including this Proxy Summary and Part 3 – “Named | ||||

42016 PROXY STATEMENTMicrosoft 5

Table of ContentsExecutive compensation advisory vote

Our Board of Directors recommends that shareholders vote to approve, on an advisory basis, the compensation paid to the Company’s named executive officers as described in this Proxy Statement (the “say-on-pay” vote), for the following reasons.

Pay for performance | ||||||||||

| ||||||||||

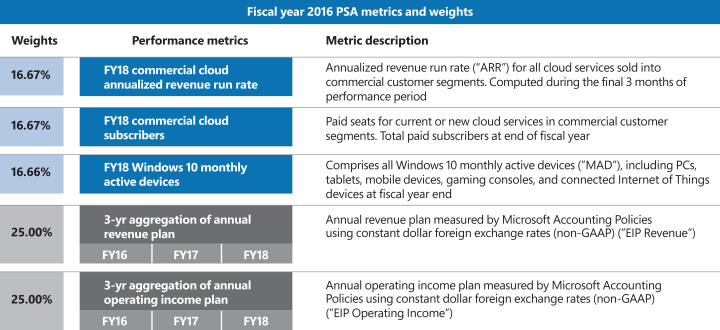

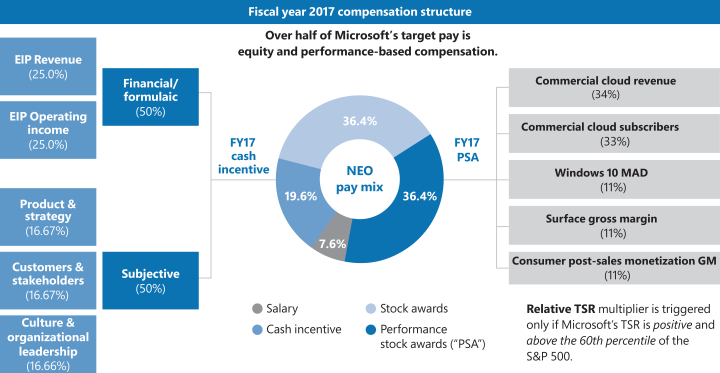

The evolution of executive compensation for fiscal year 2016 and Executing on our | Fiscal year 2016 executive compensation. At least 70% of target compensation for our Chief Executive Officer (“CEO”) and other named executive officers (collectively, the “Named Executives”) was equity-based, providing direct alignment with returns to shareholders and incentives to drive long-term business success. The annual cash incentive awards for our Named Executives ranged from 100% to 140% of target consistent with our business performance and returns to shareholders. Mr. Nadella’s cash incentive was determined based on his performance in four weighted categories as described in greater detail in Part 3 – “Named executive officer compensation”. There were no special awards. | |||||||||

Sound program design | ||||

| ||||

We designed our executive officer compensation programs to attract, motivate, and retain the key executives who drive our success and industry leadership while considering individual and Company performance and alignment with the interests of | ||||

|

| |||

|

| |||

|

| |||

|

| |||

Best practices in executive compensation | |||||

|

| ||||

|

|

| |||

| Our leading practices include:

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

| 1 | CORPORATE GOVERNANCE AT MICROSOFT | 2 | BOARD OF DIRECTORS | 3 | NAMED EXECUTIVE OFFICER COMPENSATION | 4 | AUDIT COMMITTEE MATTERS | 5 | INFORMATION ABOUT THE MEETING |

| ||||||

|

1. Corporate governance at Microsoft

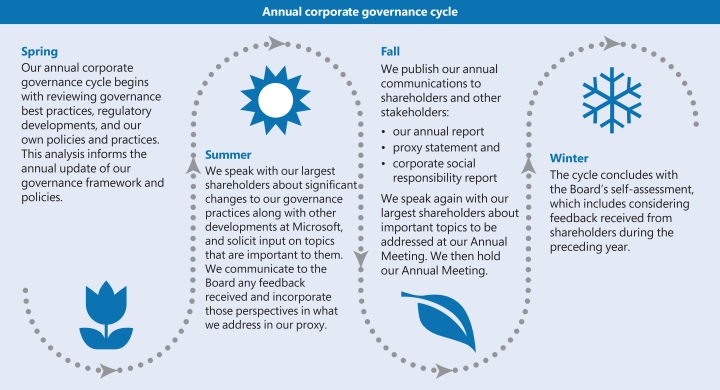

Shareholder outreach and ourOur corporate governance cycle

promotes effective shareholder engagement

Microsoft believes that effective corporate governance should include regular, constructive conversations with our shareholders. We actively engage with our shareholders as part of our annual corporate governance cycle described below.

|

An important component of transparency is effectively communicating

We are transparent – Communicating governance policies and practices to all shareholders and other stakeholders.stakeholders is an important part of our commitment to transparency. With over 3.43.5 million Microsoft shareholders, using both direct dialogue and ‘one-tomany’‘one-to-many’ communications are necessary to provide the scale to reach all shareholders. To this end, during the past fiscal year Microsoft took the following steps to engage these communities.

Shareholder OutreachWe proactively engage with our shareholders –Independent During fiscal year 2016, independent members of our Board and members of senior management conducted outreach to a cross-section of shareholders owning approximately 40% of our outstanding shares. Our CEO, Satya Nadella, remains committed to investing time with our shareholders to increase transparency and better understand their perspectives, including by participating in our quarterly earnings calls and other forums for communication.

Director Video SeriesOur director video series provides all stakeholders insight about our Board –We recently released the sixth installmenttwo new installments of our director video series featuring interviews with members of our Board. The videos provide an informal opportunity for Microsoft’s directors to discuss their approach to serving as a director at Microsoft. The complete series can be viewed on Microsoft’s Investor Relations site atwww.microsoft.com/investor/CorporateGovernance/BoardOfDirectors/default.aspx.

| 1 | CORPORATE GOVERNANCE AT MICROSOFT | 2 | BOARD OF DIRECTORS | 3 | NAMED EXECUTIVE OFFICER COMPENSATION | 4 | AUDIT COMMITTEE MATTERS | 5 | INFORMATION ABOUT THE MEETING |

Microsoft on the Issues blogs address our views on emerging governance topics – We continued to make regular policy blog posts on Microsoft on the Issues. Blogs included a synopsis of our commitment to shareholder engagement, including the latest in the series of director interviews our adoption of proxy access and other topics of importance including citizenship,corporate social responsibility, privacy, cybersecurity, online safety, jobs, and education. We disseminated information posted on the Microsoft on the Issues blog via a number of social media handles, including @MSFTIssues and @MSFTNews.

Corporate Web Site.2016 PROXY STATEMENT 7

Investor Relations website delivers extensive content about governance and corporate social responsibility – Our investor relations site incorporatesInvestor Relations website provides in-depth information about our corporate governance and citizenship content, which are important topicscorporate social responsibility initiatives to investors.our shareholders and other stakeholders.

CorporateOur progressive corporate governance framework

Corporate governance at Microsoft is designed to promote the long-term interests of our shareholders, maintain internal checks and balances, strengthen management accountability, engender public trust, and foster responsible decision making and accountability.

Our corporate governance framework is designed to ensure our Board has the necessary authority and practices in place to review and evaluate our business operations and to make decisions independent of management. Our goal is to align the interests of directors, management, and shareholders, and comply with or exceed the requirements of the NASDAQ Stock Market (“NASDAQ”) and applicable law. This framework establishes the practices our Board follows with respect to:

Our corporate governance documents

|

| Amended and Restated Articles of Incorporation |

| Bylaws |

| Corporate Governance Guidelines |

| Director Independence Guidelines |

| Microsoft Finance Code of Professional Conduct |

| Microsoft Standards of Business Conduct |

| Audit Committee Charter and Responsibilities Calendar |

| Compensation Committee Charter |

| Governance and Nominating Committee Charter |

| Regulatory and Public Policy Committee Charter |

| Stock Ownership and Holding Requirements for | |

| Microsoft Corporation Executives |

| Executive Compensation Recovery Policy |

| Compensation Consultant Independence Standards |

These documents are all available athttp://aka.ms/policiesandguidelines.

IndependentWe have an independent Chairman of the Board

John Thompson serves as independent Chairman of the Board. The roles of chairman and chief executive officer have been separate since 2000.

The independent directors annually appoint a Chairman of the Board.our Chairman. As Chairman, Mr. Thompson leads the activities of the Board, including:

2015 Proxy Statement 7

| 8 |  |

| 1 | CORPORATE GOVERNANCE AT MICROSOFT | 2 | BOARD OF DIRECTORS | 3 | NAMED EXECUTIVE OFFICER COMPENSATION | 4 | AUDIT COMMITTEE MATTERS | 5 | INFORMATION ABOUT THE MEETING |

He also performsperforming the other duties specified in the Corporate Governance Guidelines or assigned by the Board.

Our Board believes its leadership structure effectively allocates authority, responsibility, and oversight between management and the independent members of our Board. It gives primary responsibility for the operational leadership and strategic direction of the Company to our CEO, while the Chairman facilitates our Board’s independent oversight of management, promotes communication between management and our Board, engages with shareholders, and leads our Board’s consideration of key governance matters. The Board believes its programs for overseeing risk would be effective under a variety of leadership frameworks and therefore do not materially affect how it structures its leadership.

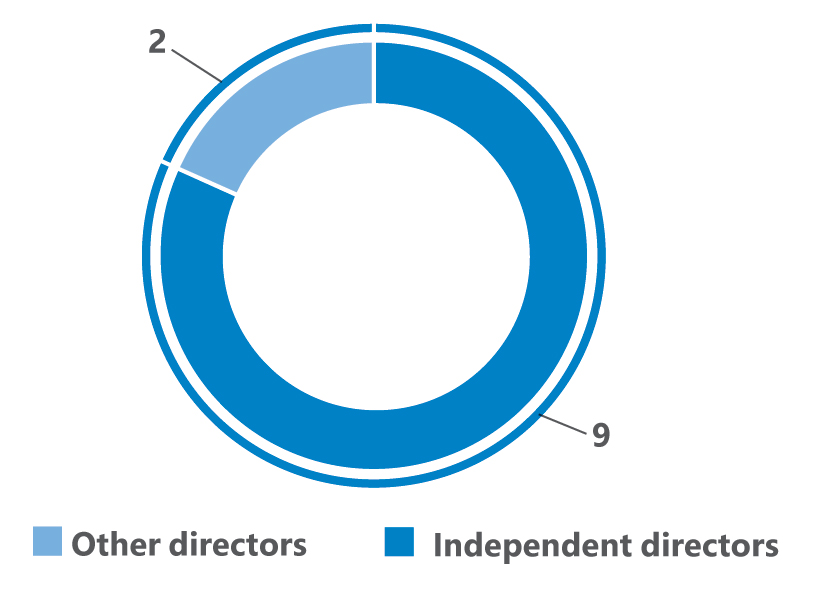

| • | Nine of eleven directors are independent – We are committed to maintaining a substantial majority of directors who are independent of the Company and management. Except for Satya Nadella, our CEO, and Bill Gates, all directors are independent. |

| • | Quarterly executive sessions of independent directors– At each quarterly Board meeting, time is set aside for the independent directors to meet in executive session without Company management present. Additional executive sessions are held as needed. |

| • | Independent compensation consultant – The compensation consultant retained by the Compensation Committee is independent of the Company and management as described in our Compensation Consultant Independence Standards. |

Board committee independence and expertise

| • | Committees are independent – Only independent directors are members of the Board’s committees. |

| • | Regularcommittee executive sessions of independent directors– At each regularly scheduled meeting, members of the Audit Committee, Compensation Committee, and Regulatory and Public Policy Committee meet in executive session. Additional executive sessions of all Board committees are held as needed. |

| • | Audit Committee financial sophistication and expertise– All members of the Audit Committee meet the NASDAQ listing standard of financial sophistication. Ms. List-Stoll, Mr. Noski, and Dr. Panke are “audit committee financial experts” under Securities and Exchange Commission (“SEC”) rules. |

| • | Majority voting – In an uncontested election, directors are elected by the majority of votes cast. |

| • | Annual elections – All directors are elected annually. Microsoft does not have a classified board. |

| • | Proxy access – We have a “Proxy Access for Director Nominations” bylaw, that permits eligible shareholders to nominate candidates for election to the Microsoft Board. Proxy access candidates will be included in the Company’s proxy statement and ballot. The proxy access bylaw provides that holders |

| of at least 3 percent of Microsoft’s outstanding shares held by up to 20 shareholders | holding the shares continuously for at least 3 years | can nominatetwo candidates or 20% of the Board, whichever is greater, for election at an annual shareholders meeting |

| • | Confidential voting – We have a confidential voting policy to protect the voting privacy of our individual shareholders. |

| • | Special meetings – If Proposal 4 is approved, holders of 15% of outstanding shares can call a special meeting. |

●2016 PROXY STATEMENTMajority voting– We have a majority vote standard for director elections. In an uncontested election, directors are elected by the majority of votes cast. 9

– In August 2015, our Board adopted a “Proxy Access for Director Nominations” bylaw, which permits eligible shareholdersOur approach to nominate candidates for election to the Microsoft Board. Proxy access candidates will be included in the Company’s proxy statement and ballot. The proxy access bylaw provides that holders:

In each case,

| • | Board – The Board directly oversees strategic risks to the Company and other risk areas not delegated to one of its committees. |

| • | Committees – |

Audit Committee | Compensation Committee | Regulatory and Public Policy Committee | ||

Reviews and assesses the Company’s processes to manage financial reporting risk and to manage investment, tax, and other financial risks. It also reviews the Company’s policies for risk assessment and steps management has taken to control significant risks, except those delegated by the Board to other committees. | Oversees compensation programs and policies and their effect on risk taking by management. | Oversees risks related to competition and antitrust, data privacy and cybersecurity, and workforce and immigration laws and regulations. |

Management periodically reports to the Board or relevant committee, which provides guidance on risk assessment and mitigation. Each committee charged with risk oversight reports up to the Board on those matters.

8Microsoft

| 1 | CORPORATE GOVERNANCE AT MICROSOFT | 2 | BOARD OF DIRECTORS | 3 | NAMED EXECUTIVE OFFICER COMPENSATION | 4 | AUDIT COMMITTEE MATTERS | 5 | INFORMATION ABOUT THE MEETING |

| • | Stock ownership requirements – We have stock ownership policies for directors, executive officers, and other senior executives to promote a long-term perspective in managing the enterprise and to help align the interests of our shareholders, executives, and directors. |

| • | Compensation clawback – We have a strong ‘no-fault’ executive compensation recovery policy that applies to executive officers and our principal accounting officer. |

| • | Hedging and pledging prohibited – We prohibit our directors and executive officers from hedging their ownership of Microsoft stock, including trading in options, puts, calls, or other derivative instruments related to Company stock or debt. Directors and executive officers are prohibited from purchasing Microsoft stock on margin, borrowing against Microsoft stock held in a margin account, or pledging Microsoft stock as collateral for a loan. |

Director orientation and continuing education

| • | Board orientation – Our orientation programs familiarize new directors with Microsoft’s businesses, strategies, and policies, and assist new directors in developing the skills and knowledge required for their service on the Board of Directors. |

| • | Continuing education – Continuing education programs assist directors in maintaining skills and knowledge necessary or appropriate for the performance of their responsibilities. These programs may include internally developed materials and presentations, programs presented by third parties, and financial and administrative support to attend qualifying academic or other independent programs. |

Annual Board and committee evaluations

Each year, our Board and its committees conduct self-evaluationsevaluations to assess their effectiveness and adherence to the Corporate Governance Guidelines and committee charters, and to identify opportunities to improve Board and committee performance.

| • | Board evaluation– The Governance and Nominating Committee conducts an annual evaluation of the performance of the Board and each of its members. The results are reported to the Board. The report includes an assessment of the Board’s compliance with the principles in the Corporate Governance Guidelines, and identification of areas in which the Board could improve its performance. |

| • | Committee evaluations – Each committee conducts an annual performance evaluation and reports the results to the Board. Each committee’s report includes an assessment of the committee’s compliance with the principles in the Corporate Governance Guidelines and the committee’s charter, as well as identification of areas in which the committee could improve its performance. |

Corporate social responsibility

A key part of the performance of the Board and each of its members. The results are reported to the Board. The report includes an assessment of the Board’s compliance with the principles in the Corporate Governance Guidelines, and identification of areas in which the Board could improve its performance.

Microsoft’s citizenship mission is to serve globally the needs of communities and fulfillhow Microsoft fulfills our responsibilities to the public. With our citizenship commitments, we seek to advance our Company mission to empower every person and every organization on the planet to achieve more is through our corporate policies and business practices, ourthe products and services we provide. Achieving our investmentsmission also requires a strong commitment to corporate social responsibility: to conduct our business in communities.ways that are principled, transparent, and accountable to key stakeholders. We believe doing so generates long-term value for our business, our shareholders, and communities around the world.

|

2015 Proxy Statement9

| 1 | CORPORATE GOVERNANCE AT MICROSOFT | 2 | BOARD OF DIRECTORS | 3 | NAMED EXECUTIVE OFFICER COMPENSATION | 4 | AUDIT COMMITTEE MATTERS | 5 | INFORMATION ABOUT THE MEETING |

Given the importance of citizenship to Microsoft’s long-term business success, the responsibilities of the Regulatory and Public Policy Committee include reviewing and providing guidance to the Board and management about the Company’s policies and programs that relate to corporate citizenship, including human rights, environmental sustainability, corporate social responsibility supply chain management, charitable giving,commitments include the areas of accessibility, corporate governance, environmental sustainability, empowering our people, ethical business conduct, human rights, privacy, and political activitiesresponsible sourcing. In addition, through Microsoft Philanthropies, we are investing Microsoft’s assets – our technology, investments, voice, and expenditures.people – to drive greater inclusion and empowerment of people who do not have access to technology and the opportunities it offers and enables.

For an in-depth reviewAtwww.microsoft.com/csr we share a broad range of Microsoft’s approach to corporate citizenshipinformation on our policies, practices, and performance in fiscal year 2015, please visitacross all these areas and others, ranging from our 2015 Microsoft Citizenship Report atwww.microsoft.com/citizenshipreport.carbon footprint to how we’ve responded to requests from law enforcement agencies for customer data. Ultimately, our goal is to meet the high standards we have for ourselves and to consistently earn the trust and confidence of the public, our customers, partners, employees, and shareholders.

Political contributions transparency

Microsoft recognizes the increasing interest of U.S. public company shareholders in establishing greater transparency about corporate political contributions. We disclose our political contributions to support candidates and ballot measures and how certain of our trade association membership dues are used for political activities. As part of our commitment to transparency, we developed our Principles and Policies Guiding Microsoft Participation in Public Policy Process in the United States, which focus on ensuring compliance with applicable federal and state laws and are designed to go beyond compliance to implement what we consider leading practices in corporate accountability, transparency, integrity, and responsibility. The policy is available atwww.microsoft.com/politicalengagement.

How to communicate with our Board.

Shareholders are invitedWe invite shareholders to contact the Board about corporate governance or matters related to the Board of Directors. Inquiries meetingBoard. Communications about these criteriatopics will be received and processed by management before being forwarded to the Board, a committee of the Board, or a director as designated in your message. Communications relating to other topics, including those that are primarily commercial in nature, will not be forwarded.

| ||||

| @ | AskBoard@microsoft.com | |||

|

| |||

| MSC 123/9999 Office of the Corporate Secretary Microsoft Corporation One Microsoft Way Redmond, WA 98052-6399 | |||

Concerns about accounting or auditing matters or possible violations of our Standards of Business Conduct should be reported under the procedures outlined in the Microsoft Standards of Business Conduct, which is available on our website athttp://aka.ms/buscond.

10Microsoft

Table2. Board of ContentsDirectors

| 1 | CORPORATE GOVERNANCE AT MICROSOFT | 2 | BOARD OF DIRECTORS | 3 | NAMED EXECUTIVE OFFICER COMPENSATION | 4 | AUDIT COMMITTEE MATTERS | 5 | INFORMATION ABOUT THE MEETING |

|

Election of | |||

| |||

The Board has nominated 11 directors Each director will be elected by a vote of the majority of the votes cast, meaning that the number of shares cast “for” a director’s election exceeds the number of votes cast “against” that director.

|

| Name | Age | Director since | Occupation | ||||

| William H. Gates III | 59 | 1981 | Co-Chair and Trustee, Bill & Melinda Gates Foundation | ||||

| Teri L. List-Stoll | 52 | 2014 | Executive Vice President and CFO, DICK’S Sporting Goods, Inc. | ||||

| G. Mason Morfit | 40 | 2014 | President, ValueAct Capital | ||||

| Satya Nadella | 48 | 2014 | CEO, Microsoft | ||||

| Charles H. Noski | 63 | 2003 | Former Vice Chairman, Bank of America Corporation | ||||

| Helmut Panke | 69 | 2003 | Former Chairman of the Board of Management, BMW Bayerische | ||||

| Motoren Werke AG | |||||||

| Sandra E. Peterson | 56 | N/A | Group Worldwide Chairman, Johnson & Johnson | ||||

| Charles W. Scharf | 50 | 2014 | CEO, Visa, Inc. | ||||

| John W. Stanton | 60 | 2014 | Chairman, Trilogy International Partners, Inc. | ||||

| John W. Thompson | 66 | 2012 | Independent Chairman, Microsoft; CEO, Virtual Instruments, Inc. | ||||

| Padmasree Warrior | 55 | N/A | Former Chief Technology and Strategy Officer, Cisco Systems, Inc. |

| ||||

SelectionOur Board of Directors recommends a vote FOR the election to the Board of each of the following nominees:

Name

|

Age

|

Director since

|

Occupation

| |||

William H. Gates III

| 60 | 1981 | Co-Chair and Trustee, Bill & Melinda Gates Foundation | |||

Teri L. List-Stoll

| 53 | 2014 | Former Executive Vice President and CFO, DICK’S Sporting Goods, Inc. | |||

G. Mason Morfit

| 41 | 2014 | President, ValueAct Capital | |||

Satya Nadella

| 49 | 2014 | CEO, Microsoft | |||

Charles H. Noski

| 64 | 2003 | Former Vice Chairman, Bank of America Corporation | |||

Helmut Panke

|

70 |

2003 |

Former Chairman of the Board of Management, BMW Bayerische Motoren Werke AG

| |||

Sandra E. Peterson

| 57 | 2015 | Group Worldwide Chairman, Johnson & Johnson | |||

Charles W. Scharf

| 51 | 2014 | CEO, Visa, Inc. | |||

John W. Stanton

| 61 | 2014 | Chairman, Trilogy Partnerships | |||

John W. Thompson

| 67 | 2012 | Independent Chairman, Microsoft; Former CEO, Virtual Instruments, Inc. | |||

Padmasree Warrior

| 55 | 2015 | U.S. CEO and global Chief Development Officer, NextEV |

Director selection and qualifications

How we select Board members

The Company’s shareholdersShareholders elect all Board members annually. The Governance and Nominating Committee recommends to the Board director candidates for nomination and election at the annual shareholders meeting or for appointment to fill vacancies. The Governance and Nominating Committee annually reviews with the Board the skills and characteristics required of Board nominees, considering current Board composition and Company circumstances. In making its recommendations to our Board, the Governance and Nominating Committee considers the qualifications of individual director candidates in light ofapplying the Board membership criteria described below. The Governance and Nominating Committee retains any search firmsfirm involved in identifying potential candidates and approves payment of their fees.

2015 Proxy Statement 11

| 12 |  |

| 1 | CORPORATE GOVERNANCE AT MICROSOFT | 2 | BOARD OF DIRECTORS | 3 | NAMED EXECUTIVE OFFICER COMPENSATION | 4 | AUDIT COMMITTEE MATTERS | 5 | INFORMATION ABOUT THE MEETING |

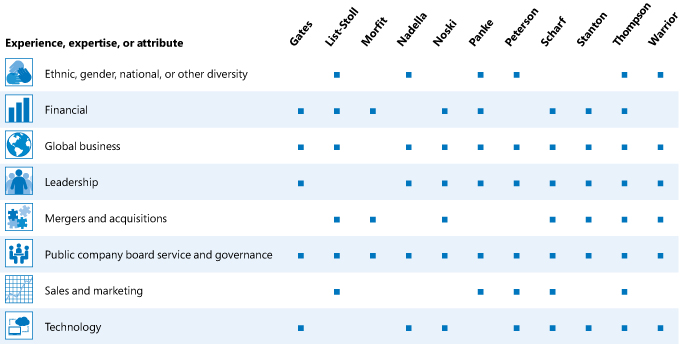

Board membership criteria

The Governance and Nominating Committee works with our Board to determine the characteristics, skills, and experiences for the Board as a whole and its individual members with the objective of having a Board with diverse backgrounds and experience in business, education, and public service. Characteristics expected of all directors include

| |

| |

| |

| |

|

In evaluating the suitability of individual Board members, our Board considers many factors, including general understanding of marketing, finance, and other disciplines relevant to the success of a large, publicly traded company in today’s business environment; understanding of our business and technology; educational and professional background; personal accomplishment; and geographic, gender, age, and ethnic diversity. The Board is committed to actively seeking highly qualified women and individuals from minority groups to include in the pool from which Board nomineesnew candidates are selected. Our Board evaluates each individual in the context of the Board as a whole, with theThe Board’s objective of recommendingis to recommend a group that can best perpetuate the success of our business and represent shareholder interests through the exercise of sound judgment using its diversity of experience.experience and perspectives.

In determining whether to recommend a director for re-election, the Governance and Nominating Committee considers the director’s past attendance at meetings, participation in and contributions to the activities of the Board, and the results of the most recent Board evaluation.

The Governance and Nominating Committee assesses its efforts to maintain an effective and diverse Board of Directors in the course of its regular responsibilities, which include annually

| |

reporting to our Board on the performance and effectiveness of the Board, presenting to our Board individuals recommended for election | |

|

In addition to the Board at the annual review of the Board composition,meeting, and

The Governance and Nominating Committee also works with the full Board to regularly evaluate theBoard composition of the Board to assess whether one or more directors should be added in view of director departures, the number of directors needed to fulfill the Board’s responsibilities under the Corporate Governance Guidelines and committee charters, and the skills and capabilities that are relevant to the Board’s work and the Company’s strategy.

2016 PROXY STATEMENT 13

Shareholders previously elected all current Board members. In recruiting the two new director nominees, Mmes. Peterson and Warrior, the Governance and Nominating Committee retained the search firm of Spencer Stuart to help identify director prospects, perform candidate outreach, assist in reference and background checks, and provide other related services. The recruiting process typically involves either the search firm or a member of the Governance and Nominating Committee contacting a prospect to gauge his or her interest and availability. A candidate will then meet with several members of the Board including Mr. Nadella, and then meet with members of management as appropriate. At the same time, the Governance and Nominating Committee and the search firm will contact references for the prospect. A background check is completed before a final recommendation is made to the Board to appoint a candidate to the Board.

12Microsoft

| 1 | CORPORATE GOVERNANCE AT MICROSOFT | 2 | BOARD OF DIRECTORS | 3 | NAMED EXECUTIVE OFFICER COMPENSATION | 4 | AUDIT COMMITTEE MATTERS | 5 | INFORMATION ABOUT THE MEETING |

The table below summarizes key qualifications, skills, and attributes most relevant to the decision to nominate candidates to serve on the Board of Directors. A mark indicates a specific area of focus or expertise on which the Board relies most. The lack of a mark does not mean the director does not possess that qualification or skill. Each director biographyDirector biographies below describesdescribe each director’s qualifications and relevant experience in more detail.

|  |  |  |  |  |  |  |  |  |  |  | |

|

| |||||||||||

|

| |||||||||||

|

| |||||||||||

|

| |||||||||||

|

| |||||||||||

|

| |||||||||||

|

| |||||||||||

|

|

|  |

Shareholder recommendations and nominations of director candidates

Shareholder recommendations

The Governance and Nominating Committee considers shareholder recommendations for candidates for the Board of Directors using the same criteria described above. The name of any recommended candidate for director, together with a brief biographical sketch, a document indicating the candidate’s willingness to serve if elected, and evidence of the nominating shareholder’s ownership of Company stock must be sent to the attention of MSC 123/9999, Office of the Corporate Secretary, Microsoft Corporation, One Microsoft Way, Redmond, WA 98052-6399.

Shareholder nominations

In addition, asAs described in Part 1 – “Corporate Governancegovernance at Microsoft – Shareholder Authority,rights,” our Bylaws provide for proxy access shareholder nominations of director candidates. A shareholder who wishes to formally nominate a candidate must follow the procedures described in Article 1 of our Bylaws.

2015 Proxy Statement 13

| 1 | CORPORATE GOVERNANCE AT MICROSOFT | 2 | BOARD OF DIRECTORS | 3 | NAMED EXECUTIVE OFFICER COMPENSATION | 4 | AUDIT COMMITTEE MATTERS | 5 | INFORMATION ABOUT THE MEETING |

|

| |

|

|

|

|

|

|

|

|

|

|

Age59 Director since1981Mr. Gates, a cofounder of Microsoft, served as Chairman from our incorporation in 1981 until 2014. He currently acts as a Technical Advisor to Mr. Nadella on key development projects. Mr. Gates retired as an employee in 2008. Mr. Gates served as Chief Software Architect from 2000 until 2006, when he announced his two-year plan to transition out of a day-to-day full-time employee role. Mr. Gates served as Chief Executive Officer from 1981 until 2000, when he resigned as Chief Executive Officer and assumed the position of Chief Software Architect. As co-chair of the Bill & Melinda Gates Foundation, Mr. Gates shapes and approves grant-making strategies, advocates for the foundation’s issues, and helps set the overall direction of the organization.

| ||||||

| 14 |  |

| Age: 60 |Director since: 1981 |Microsoft Committees: None Other Public Company Directorships: Berkshire Hathaway Inc. Summary: Mr. Gates, a co-founder of Microsoft, served as Chairman from our incorporation in 1981 until 2014. He currently acts as a Technical Advisor to Mr. Nadella on key development projects. Mr. Gates retired as an employee in 2008. Mr. Gates served as Chief Software Architect from 2000 until 2006, when he announced his two-year plan to transition out of a full-time employee role. Mr. Gates served as Chief Executive Officer from 1981 until 2000, when he resigned as Chief Executive Officer and assumed the position of Chief Software Architect. As co-chair of the Bill & Melinda Gates Foundation, Mr. Gates shapes and approves grant-making strategies, advocates for the foundation’s issues, and helps set the overall direction of the organization. Qualifications:As a founder of Microsoft, Mr. Gates’

| |||||

| Financial | |||||

| Global business | |||||

| Leadership | |||||

| Public company board service and governance | |||||

| Technology | |||||

| Age: 53 |Director since: 2014 |Microsoft Committees: Audit, Governance and Nominating Other Public Company

Summary: Ms. List-Stoll served as Executive Vice President and Chief Financial Officer of DICK’S Sporting Goods, Inc. from August 2015 to September 2016, where she was responsible for finance and legal activities, including financial planning and analysis, accounting, treasury, taxes, internal audit, compliance, acquisitions and divestitures, and investor relations. From December 2013 to March 2015, Ms. List-Stoll served as Executive Vice President and Chief Financial Officer for Kraft Foods Group, and then as a senior advisor through May 2015. As CFO, she led Kraft’s finance, information services, and business process excellence organizations and was responsible for financial planning, financial accounting and reporting, internal audit, treasury, tax, acquisitions and divestitures, and investor relations. Ms. List-Stoll joined Kraft in September 2013 as Senior Vice President leading the business unit finance teams. Prior to Kraft, Ms. List-Stoll was at Procter & Gamble (“P&G”) for nearly 20 years, where she last served as Senior Vice President and Treasurer. Ms. List-Stoll started with P&G in 1994 and held finance leadership roles across a diverse range of areas including business unit management, supply chain, sales, accounting, and financial planning and analysis. From 1991 to 1993, Ms. List-Stoll was a fellow with the Financial Accounting Standards Board (“FASB”). Prior to her fellowship at FASB, she spent six years at Deloitte & Touche, providing financial counsel to large multinational companies. | |||||

14Microsoft

| 1 | CORPORATE GOVERNANCE AT MICROSOFT | 2 | BOARD OF DIRECTORS | 3 | NAMED EXECUTIVE OFFICER COMPENSATION | 4 | AUDIT COMMITTEE MATTERS | 5 | INFORMATION ABOUT THE MEETING |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Age52 Director since2014Ms. List-Stoll joined DICK’S Sporting Goods, Inc. as Executive Vice President and Chief Financial Officer in August 2015. From December 2013 to March 2015, Ms. List-Stoll served as Executive Vice President and Chief Financial Officer for Kraft Foods Group, and then as a senior advisor through May 2015. As CFO, she led Kraft’s finance, information services, and business process excellence organizations and was responsible for financial planning, financial accounting and reporting, internal audit, treasury, tax, acquisitions and divestitures, and investor relations. Ms. List-Stoll joined Kraft in September 2013 as Senior Vice President leading the business unit finance teams. Prior to Kraft, Ms. List-Stoll was at Procter & Gamble (“P&G”) for nearly 20 years, where she last served as Senior Vice President and Treasurer. Ms. List-Stoll started with P&G in 1994 and held finance leadership roles across a diverse range of areas including business unit management, supply chain, sales, accounting, and financial planning and analysis. From 1991 to 1993, Ms. List-Stoll was a fellow with the Financial Accounting Standards Board (“FASB”). Prior to her fellowship at FASB, she spent six years at Deloitte & Touche, providing financial counsel to large multinational companies.

| ||||

Ms. List-Stoll brings to the Board significant financial expertise, having spent her professional career in a broad range of finance and accounting roles. She has exceptional financial and operational experience from her two decades in consumer goods and retail industries. As Executive Vice President and Chief Financial Officer for DICK’S Sporting Goods and in her previous roles at Kraft Foods Group and P&G, Ms. List-Stoll has a proven record of accomplishment leading diverse and complex financial functions, providing an understanding of complex financial management and accounting matters similar to those Microsoft faces. Her experience involving business unit management, supply chain, and sales at a major consumer products company provides valuable insights into the Company’s consumer opportunities.

| ||||

| Ethnic, gender, national, or other diversity | |||

| Financial | |||

| Global business | |||

| Mergers and acquisitions | |||

| Public company board service and governance | |||

| Sales and marketing |

2016 PROXY STATEMENT 15

| Age: 41 |Director since: 2014 |Microsoft Committees: Audit, Compensation Other Public Company

| |||||

2015 Proxy Statement 15

| 1 | CORPORATE GOVERNANCE AT MICROSOFT | 2 | BOARD OF DIRECTORS | 3 | NAMED EXECUTIVE OFFICER COMPENSATION | 4 | AUDIT COMMITTEE MATTERS | 5 | INFORMATION ABOUT THE MEETING |

Qualifications: | |

|

| |

|

|

|

|

|

|

Age40 Director since2014Mr. Morfit is the President of ValueAct Capital, a significant Microsoft shareholder. He has been a non-managing member of ValueAct Capital Management, L.P. since 2003 and was an associate with ValueAct Capital from January 2001 to December 2002. Prior to joining ValueAct Capital, Mr. Morfit worked in equity research for Credit Suisse First Boston from 1999 to 2000. He has a B.A. from Princeton University, and is a former CFA charter holder.

| ||||

Mr. Morfit is a seasoned investor involved in strategic planning for other public and private companies, including companies involved in significant periods of transition. His experience on the audit, governance, and compensation committees of other public companies positions him to be a valuable and versatile asset in a variety of contexts and committee roles. Mr. Morfit has substantial experience in analyzing financial statements and capital allocation decisions. | ||||

| Financial | |||

| Mergers and acquisitions | |||

| Public company board service and governance |

| Age: 49 |Director since: 2014 |Microsoft Committees: None Other Public Company None Former Public Company Directorships Held in the Past Five

| |||||

16Microsoft

| 1 | CORPORATE GOVERNANCE AT MICROSOFT | 2 | BOARD OF DIRECTORS | 3 | NAMED EXECUTIVE OFFICER COMPENSATION | 4 | AUDIT COMMITTEE MATTERS | 5 | INFORMATION ABOUT THE MEETING |

|

| |

|

|

|

|

|

|

|

|

|

|

Age48 Director since2014

Mr. Nadella was appointed Chief Executive Officer and a Director in February 2014. He served as Executive Vice President, Cloud and Enterprise since July 2013. From 2011 to 2013, Mr. Nadella served as President, Server and Tools. From 2009 to 2011, he was Senior Vice President, Online Services Division. From 2008 to 2009, he was Senior Vice President, Search, Portal and Advertising. Since joining Microsoft in 1992, Mr. Nadella’s roles also included Vice President of the Business Division.

| ||||

Qualifications: Mr. Nadella is a proven leader with masterful engineering skills, business vision, and the ability to bring people together. His understanding of how technology will be used and experienced around the world

| ||||

| Ethnic, gender, national, or other diversity | |||

| Global business | |||

| Leadership | |||

| Public company board service and governance | |||

| Technology |

| 16 |  |

| Age: 64 |Director since: 2003 |Microsoft Committees: Audit (Chair), Governance and Nominating Other Public Company

Former Public Company Directorships Held in the Past Five

| |||||

2015 Proxy Statement 17

| 1 | CORPORATE GOVERNANCE AT MICROSOFT | 2 | BOARD OF DIRECTORS | 3 | NAMED EXECUTIVE OFFICER COMPENSATION | 4 | AUDIT COMMITTEE MATTERS | 5 | INFORMATION ABOUT THE MEETING |

|

| |||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

Mr. Noski served as Vice Chairman of Bank of America Corporation from June 2011 until September 2012. From May 2010 through June 2011, he served as Executive Vice President and Chief Financial Officer of Bank of America Corporation. From 2003 to 2005, | ||||

| ||||

| With his extensive background in finance, accounting, risk, capital markets, and business operations, Mr. Noski has a unique portfolio of business skills. He has served as a senior executive officer or head of a business unit of a major public company in a variety of contexts. A large part of Mr. Noski’s executive experience has been in the technology sector, including multinational telecommunications companies. His service with leading organizations in the accounting and auditing fields reflects his expertise in finance and accounting matters. Mr. Noski has served on a wide range of public company boards in the technology, industrial, and finance fields. | |||

| Financial | |||

| Global business | |||

| Leadership | |||

| Mergers and acquisitions | |||

| Public company board service and governance | |||

| Technology | |||

| Age: 70 |Director since: 2003 |Microsoft Other Public Company Former Public Company Directorships Held in the Past Five | |||||

| 1 | CORPORATE GOVERNANCE AT MICROSOFT | 2 | BOARD OF DIRECTORS | 3 | NAMED EXECUTIVE OFFICER COMPENSATION | 4 | AUDIT COMMITTEE MATTERS | 5 | INFORMATION ABOUT THE MEETING |

|

| |||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

Dr. Panke served as Chairman of the Board of Management of BMW Bayerische Motoren Werke AG from 2002 through 2006. From 1999 to 2002, he served as a member of the Board of Management for Finance. From 1996 to 1999, Dr. Panke was a member of the Board of Management for Human Resources and Information Technology. In his role as Chairman and Chief Executive Officer of BMW (US) Holding Corp. from 1993 to 1996, he was responsible for the company’s North American activities. He joined BMW in 1982. | ||||

| ||||

| Dr. Panke brings a global perspective to the | |||

| Ethnic, gender, national, or other diversity | |||

| Financial | |||

| Global business | |||

| Leadership | |||

| Public company board service and governance | |||

| Sales and marketing | |||

2016 PROXY STATEMENT 17

| Age: 57 |Director since: 2015 |Microsoft Other Public Company Former Public Company Directorships Held in the Past Five | |||||

| 1 | CORPORATE GOVERNANCE AT MICROSOFT | 2 | BOARD OF DIRECTORS | 3 | NAMED EXECUTIVE OFFICER COMPENSATION | 4 | AUDIT COMMITTEE MATTERS | 5 | INFORMATION ABOUT THE MEETING |

|

| |||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

Ms. Peterson has served as the Group Worldwide Chairman and member of the Executive Committee of Johnson & Johnson, a diversified global health care company with leading consumer health, pharmaceutical and medical device businesses, since December 2012. Ms. Peterson previously served as Chairman of the Board of Management of Bayer CropScience AG (a subsidiary of Bayer AG) from 2010 to 2012 and, prior to that, as a member of Bayer CropScience AG’s Board of Management from July 2010 to September 2010. Prior to that, Ms. Peterson served as Executive Vice President and President, Medical Care, Bayer HealthCare LLC from 2009 to 2010, and as President, Diabetes Care Division, from 2005 to 2009. She was Group President of Government for Medco Health Solutions, Inc. (formerly Merck-Medco) from 2003 to 2004, Senior Vice President of Medco’s health businesses from 2001 to 2003 and Senior Vice President of Marketing for Merck-Medco Managed Care LLC from 1999 to 2001. | ||||

| ||||

| Ms. Peterson’s skills include extensive operating experience with global companies, product and marketing experience, and expertise with strategy development gained from her executive positions with Johnson & Johnson, Bayer CropScience, Bayer HealthCare, and Medco Health Solutions. She has significant information technology experience, financial knowledge, and understanding of how to run a highly regulated business. Ms. Peterson has over a decade of | |||

| �� Ethnic, gender, national, or other diversity | |||

| Global business | |||

| Leadership | |||

| Public company board service and governance | |||

| Sales and marketing | |||

| Technology | |||

| Age: 51 |Director since: 2014 |Microsoft Other Public Company | |||||

| 1 | CORPORATE GOVERNANCE AT MICROSOFT | 2 | BOARD OF DIRECTORS | 3 | NAMED EXECUTIVE OFFICER COMPENSATION | 4 | AUDIT COMMITTEE MATTERS | 5 | INFORMATION ABOUT THE MEETING |

|

| |||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

Mr. Scharf has served as Chief Executive Officer and a Director of Visa Inc., a global payments company, since 2012. Previously, Mr. Scharf was a Managing Director of One Equity Partners, the private investment arm of JPMorgan Chase & Co., a global financial services firm. From 2004 to 2011, Mr. Scharf served as Chief Executive Officer of Retail Financial Services at JPMorgan Chase & Co. and from 2002 to 2004, served as Chief Executive Officer of the retail division of Bank One Corporation, a financial institution. Mr. Scharf also served as Chief Financial Officer of Bank One Corporation from 2000 to 2002, Chief Financial Officer of the Global Corporate and Investment Bank division at Citigroup, Inc., an international financial conglomerate, from 1999 to 2000, and Chief Financial Officer of Salomon Smith Barney, an investment bank, and its predecessor company from 1995 to 1999. | |||||

| |||||

| Mr. Scharf, as a sitting CEO of a large global business, adds strategic and operational depth to the | ||||

| Financial | ||||

| Global business | ||||

| Leadership | ||||

| Mergers and acquisitions | ||||

| Public company board service and governance | ||||

| Sales and marketing | ||||

| Technology | ||||

| 18 |  |

| Age: 61 |Director since: 2014 |Microsoft Other Public Company | |||||

| 1 | CORPORATE GOVERNANCE AT MICROSOFT | 2 | BOARD OF DIRECTORS | 3 | NAMED EXECUTIVE OFFICER COMPENSATION | 4 | AUDIT COMMITTEE MATTERS | 5 | INFORMATION ABOUT THE MEETING |

|

| |||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

Summary:Mr. Stanton founded Trilogy International Partners, Inc., a wireless operator in Central and South America and New Zealand, and Trilogy Equity Partners, a private equity fund that invests in early-stage growth opportunities in the wireless ecosystem in 2005, and currently serves as Chairman of both enterprises. In August 2016, he was appointed Chairman of First Avenue Entertainment LLLP, owner of the Seattle Mariners. He was a director of Clearwire Corp. from 2008 to 2013 and Chairman between 2011 to 2013. He also served as Clearwire’s Interim Chief Executive Officer during 2011. Mr. Stanton founded and served as Chairman and Chief Executive Officer of Western Wireless Corporation, a wireless telecommunications company, from 1992 until shortly after its acquisition by ALLTEL Corporation in 2005. Mr. Stanton was Chairman and a director of | ||||

| ||||

| Mr. Stanton is a recognized pioneer in the wireless telecommunications industry. His leadership of four of the top wireless operators in the United States over the past three decades positions him to contribute significantly to the development of our mobile-first and cloud-first strategies. | |||

| Financial | |||

| Global business | |||

| Leadership | |||

| Mergers and acquisitions | |||

| Public company board service and governance | |||

| Technology | |||

| Age: 67 |Director since: 2012 |Microsoft Other Public Company Former Public Company Directorships Held in the Past Five | |||||

| 1 | CORPORATE GOVERNANCE AT MICROSOFT | 2 | BOARD OF DIRECTORS | 3 | NAMED EXECUTIVE OFFICER COMPENSATION | 4 | AUDIT COMMITTEE MATTERS | 5 | INFORMATION ABOUT THE MEETING |

|

| |||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

Mr. Thompson, previously lead independent director, became independent Chairman of our Board of Directors in February 2014. He | |||||

| |||||

| Mr. Thompson has a wealth of leadership experience in the technology industry, including areas such as cloud computing and information security that are important to Microsoft’s strategic direction. As the former Chief Executive Officer of Virtual Instruments, he understands the critical importance of performance and reliability in | ||||

| Ethnic, gender, national, or other diversity | ||||

| Financial | ||||

| Global business | ||||

| Leadership | ||||

| Mergers and acquisitions | ||||

| Public company board service and governance | ||||

| Sales and marketing | ||||

| Technology | ||||

2016 PROXY STATEMENT 19

| Age: 55 |Director since: 2015 |Microsoft Other Public Company Former Public Company Directorships Held in the Past Five | |||||

| 1 | CORPORATE GOVERNANCE AT MICROSOFT | 2 | BOARD OF DIRECTORS | 3 | NAMED EXECUTIVE OFFICER COMPENSATION | 4 | AUDIT COMMITTEE MATTERS | 5 | INFORMATION ABOUT THE MEETING |

|

| |||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

Ms. Warrior was named the U.S. Chief Executive Officer and global Chief Development Officer at NextEV, an electric car startup company, in December 2015. She served as Strategic Advisor to Cisco Systems, Inc., a leading global networking equipment provider, from June to September 2015. Prior to that, she was Chief Technology and Strategy Officer from July 2012 to June 2015 and served as Chief Technology Officer, Senior Vice President Engineering and General Manager Global Enterprise segment from 2010 to 2012. She joined Cisco in 2008 as the Chief Technology Officer. Before joining Cisco, Ms. Warrior served in various executive roles at Motorola, Inc., a mobile device and telecommunications company, from 1999 to 2007, most recently as Executive Vice President and Chief Technology Officer from 2003 to 2007. Ms. Warrior | ||||

| ||||

| Ms. Warrior is widely recognized as a visionary business leader in technology. As a senior executive for Cisco, Ms. Warrior was responsible for worldwide business and technology strategy, mergers and acquisitions, equity investments, and innovation. Charged with aligning technology development and corporate strategy, she understands how to make high-stakes decisions in ambiguous and quickly evolving environments. She also has wide-ranging experience as a technical leader at Motorola addressing silicon, hardware, and software development challenges. Ms. Warrior brings significant experience in driving technology and operational innovation across a global company, and in forging growth through strategic partnerships and new business models.

| |||

| Ethnic, gender, national, or other diversity | |||

| Global business | |||

| Leadership | |||

| Mergers and acquisitions | |||

| Public board service and governance | |||

| 1 | CORPORATE GOVERNANCE AT MICROSOFT | 2 | BOARD OF DIRECTORS | 3 | NAMED EXECUTIVE OFFICER COMPENSATION | 4 | AUDIT COMMITTEE MATTERS | 5 | INFORMATION ABOUT THE MEETING |

| Technology |

Determining director independence

Having an independent board is a core element of our governance philosophy. Our Corporate Governance Guidelines provide that a substantial majority of our directors will be independent. Our Board of Directors has adopted director independence guidelines to assist in determining each director’s independence. These guidelines are available on our website atwww.microsoft.com/investor/independenceguidelines. The guidelines either meet or exceed the independence requirements of NASDAQ. The guidelines identify categories of relationships the Board has determined would not affect a director’s independence, and therefore are not considered by the Board in determining director independence.

UnderFollowing the director independence guidelines, each year or before a new director is appointed, the Board of Directors must affirmatively determine a director has no relationship that would interfere with the exercise of independent judgment in carrying out his or her responsibilities as a director. Annually, each director completes a detailed questionnaire that provides information about relationships that might affect the determination of independence. Management provides the Governance and Nominating Committee and Board with relevant known facts and circumstances of any relationship bearing on the independence of a director or nominee that is outside the categories permitted under the director independence guidelines. The Governance and Nominating Committee then completes an assessment of each director considering all known relevant facts and circumstances concerning any relationship bearing on the independence of a director or nominee. This process includes evaluating whether any identified relationship otherwise adversely affects a director’s independence, and affirmatively determining that the director has no material relationship with Microsoft, another director, or as a partner, shareholder, or officer of an organization that has a relationship with the Company.